Get answers to some of the more frequently asked questions about GST charged on Adobe products and services.

Adobe and India GST laws

Starting July 1, 2017, Adobe is required to charge 18% GST on all goods and services in accordance with India laws. This is an increase over the 15% tax rate applicable prior to July 1, 2017. For more information on GST, visit the GST - Goods and Services Tax page.

However, no GST will be charged if you enter a valid GSTIN at the time of your purchase.

Frequently Asked Questions

If you have a paid monthly plan, you will see the GST on your statement at the next billing on or after July 1, 2017. If you have a prepaid annual plan with a commitment period starting prior to July 1, 2017, the GST goes into effect at the end of your annual term.

This change does not affect the base price of your Adobe subscription or membership.

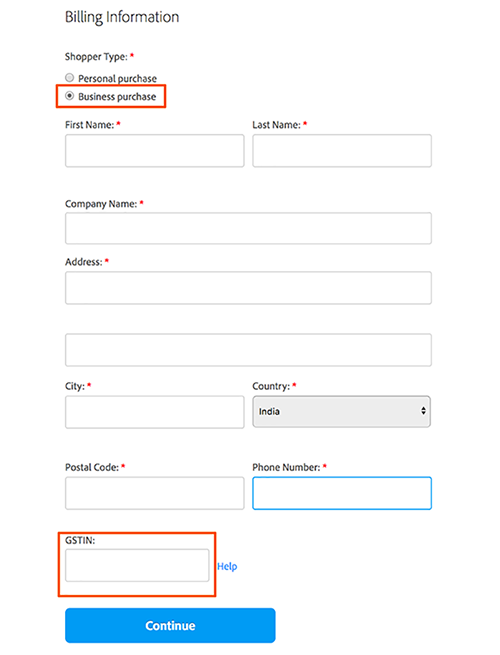

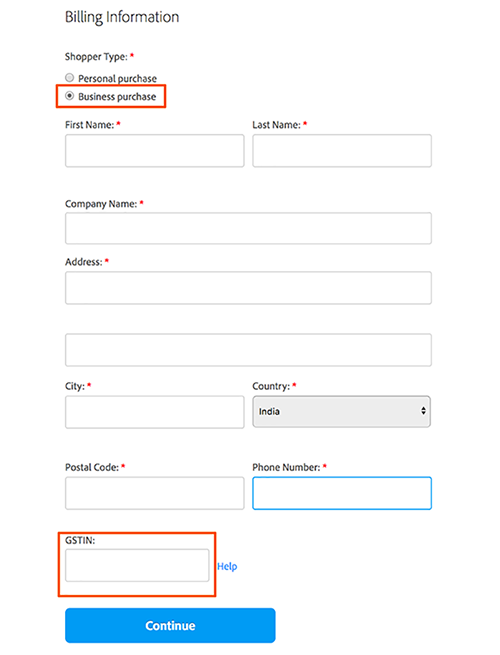

When providing your payment information during purchase on the Billing Information section, select the Business purchase option under Shopper type. This will display the GSTIN field where you can enter your GST number.

If you enter your GST number at the time of purchase, the invoice generated shows 0% GST (that is, no GST is charged).

However, if you do not enter your GST number at the time of purchase, 18% GST is charged and is shown in the invoice generated. If you subsequently want a refund of this GST charge, contact your local tax authority.

Contact Adobe Customer Care to update or delete the GST number on your existing subscriptions.

Contact Adobe Customer Care to add GST information to your past invoices. Adobe will issue you a new invoice with the GST information. This invoice can be used to file a refund claim or input credits directly with the tax authorities.

To track the status of your GST registration application, visit the Good and Services Tax website of the Indian government. Then, navigate to Select Services > Registration > Track Application Status. This will provide you information on whether your registration has been approved or validated.

The GST policy applies to all Creative Cloud subscriptions purchased via adobe.com.

Depending on certain guidelines issued by the government, the GST may either be reverse charged, or paid by the supplier or intermediary.

To learn more about the guidelines which fix the liabilities of payment of GST in particular situations, see Online Information Data Base Access and Retrieval (OIDAR).